When companies ask for our help in acquiring needed growth capital or in finding a suitable M&A counter-party that may want to explore the possibility of buying their business, they know (or they quickly discover) their financial statements will become important factors in determining how strong a hand they hold from a bargaining/negotiating standpoint.

Private equity groups and strategic buyers often use earnings figures as the initial foundation for considering whether or not a potential investment/acquisition measures up to other comparable opportunities. They employ "earnings multiples" as a standard valuation tool, multiplying earnings times three, four, five or something else -- depending on the particular location, industry or sector -- to arrive at what seems to them a fair-market price in making an opening offer to the seller.

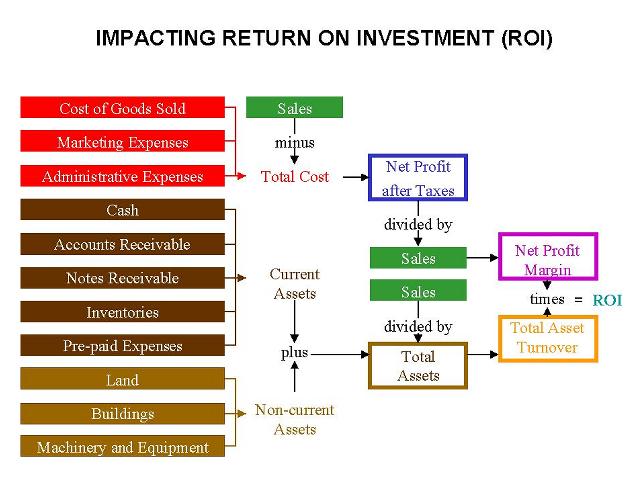

Higher earnings create significantly higher business valuations that can lead to much higher prices offered and received for a business from interested buyers. So, what immediate course of action has the best chance of producing the greatest results for a company that desires to dramatically boost its earnings as fast as possible? The answer may surprise you.

Increase sales or reduce costs?

Would you improve your company's earnings more by:

-

increasing your normal monthly sales by $100,000 in the next 30 days (taking into consideration the profit margin of your business)

-

reducing your normal monthly costs by $100,000 in the next 30 days (taking into consideration what this would mean to your "bottom line" results)

If it makes better computational sense for the real-world size of your business, change the above dollar amount to $10,000 or $1 million or whatever value you prefer.

Feel free to share your computed results with us by email. And -- if you'd like us to assist your company in reducing its costs by hundreds of thousands of dollars or more per year on a gainsharing basis, where we accept our compensation as a percentage of the amount saved -- give us a call or leave a voice message at +1 216 221 1233.